The facilities are fully leased to a roster of blue-chip customers each with numerous deployments across Digital Realtys global platform. The seed assets include.

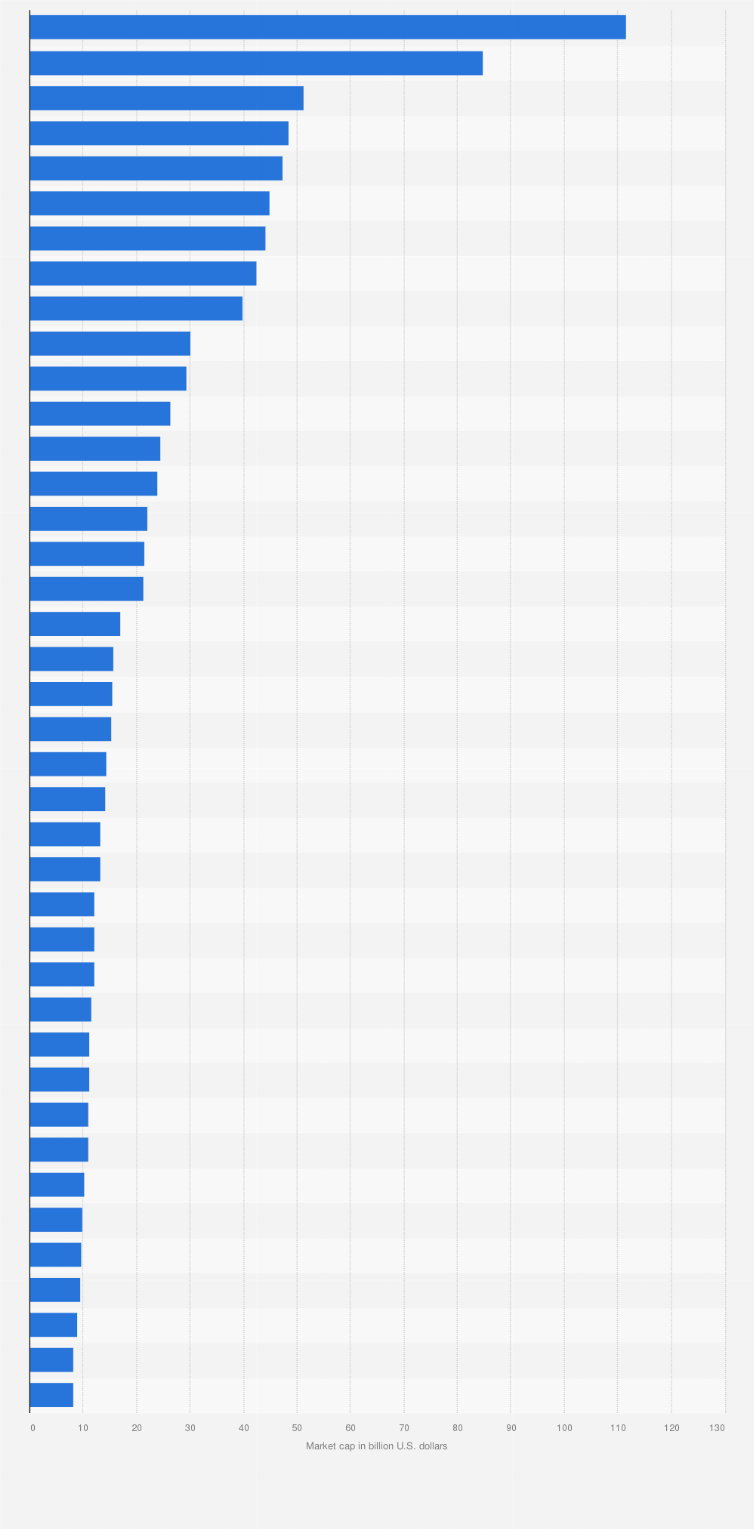

Largest Global Reit By Market Cap 2020 Statista

Digital Core REIT is expected to have an aggregate leverage of 27 per cent as at the listing date -significantly lower than its peers - giving it a debt headroom of up to US596 million.

. DIGITAL CORE REIT. Digital Core REIT News - Read the latest Digital Core REIT breaking news stay updated on business news investment company news stocks Digital Core REIT news only on The Edge Singapore. The REITs distribution policy is to distribute 100 of its annual distributable income from its listing date to the end of.

Basically a data centre REIT sponsored by Digital Realty a US listed REIT. Company profile page for Digital Core REIT Management Pte Ltd including stock price company news press releases executives board members and contact information. List of Associated Schemes.

According to the preliminary prospectus the manager intends to raise gross proceeds of approximately US977 million from the offering including the issuance of the sponsors subscription units and the. DLR released its Preliminary Prospectus announcing its intention to raise gross proceeds of 977m USD through the initial public offering IPO on the Singapore Exchange SGX of a newly created Singapore REIT S-REIT focused on data centers called Digital Core REITIncorporating drawn debt Digital Core REIT will have an enterprise value of 134bn USD upon. The address of the Businesss registered office is OCEAN FINANCIAL CENTRE 10 COLLYER QUAY Postal 049315 42-06.

Digital Realty CEO A. The company was incorporated on 02 Jul 2021 which is 04 years ago. The REIT can decide whether they.

Digital Core REIT will be the exclusive S-REIT vehicle sponsored by Digital Realty. Digital Core REIT Well Supported by Cornerstone Investors. 202123160H DIGITAL CORE REIT MANAGEMENT PTE.

At its indicative IPO price of US088 Digital Core REITs distribution yield is estimated to be 475 for the year ending 31 December 2022. Digital Core REIT sponsored by US-listed Digital Realty Trust is set to raise 600 million in an initial public offering IPO in Singapore the largest listing in the city-state this year the company said in its prospectus on Monday. The Real Estate Investment Trust which owns 10 freehold data centres in the United States and Canada worth around 14 billion is issuing.

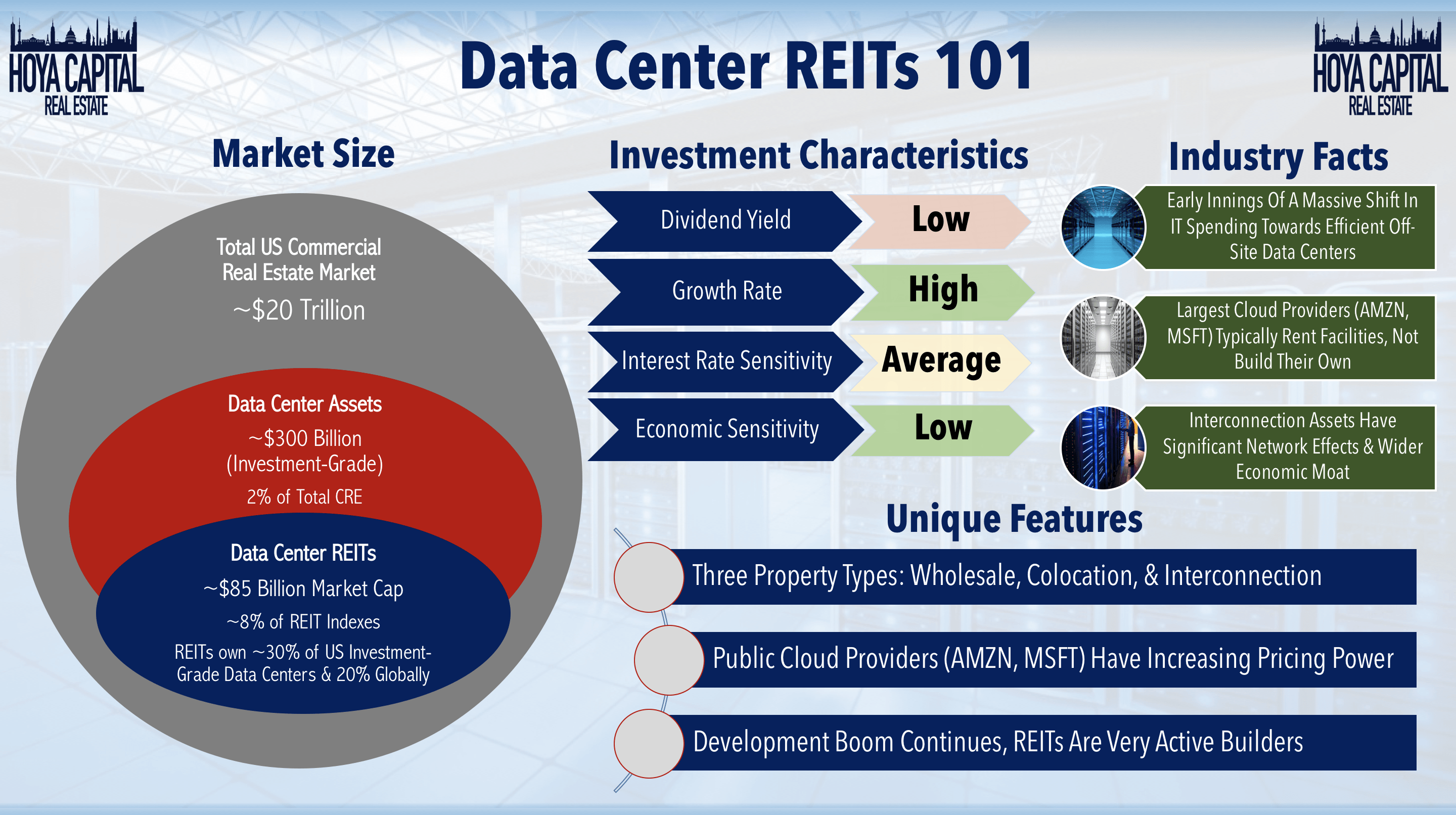

Digital Core REIT sponsored by US-listed Digital Realty Trust is set to raise 600 million in an initial public offering IPO in Singapore the largest listing in the city-state this year the company said in its prospectus on Monday. Known as the Digital Core REIT it will be the second data centre-focused REIT to list on the Singapore Exchange SGX after Keppel DC REIT made its debut in 2014. Digital Core REIT will be the exclusive S-REIT vehicle sponsored by Digital Realty the largest global provider of cloud- and carrier-neutral data centre colocation and interconnection solutions.

The 2 nd biggest is likely to be Cyxtera as they have leased at. As such it will be mainly talking about why you should not apply for the IPO. 1 Poor Rental Revision Rates.

As at listing date the REITs gearing. The sponsor is Digital Realty the largest global provider of cloud- and carrier-neutral data center co-location and interconnection services the prospectus said. Digital Core REITs Top 10 Tenants.

DIGITAL CORE REIT MANAGEMENT PTE. DIGITAL CORE REIT MANAGEMENT PTE. It will have an initial portfolio of 10 freehold data centres in US and Canada with an appraised value of US14 billion.

Unique Entity Number. The Businesss principal activity is OTHER. On that note Digital Core REITs preliminary prospectus has mentioned that its distributions will be made on a semi-annual basis.

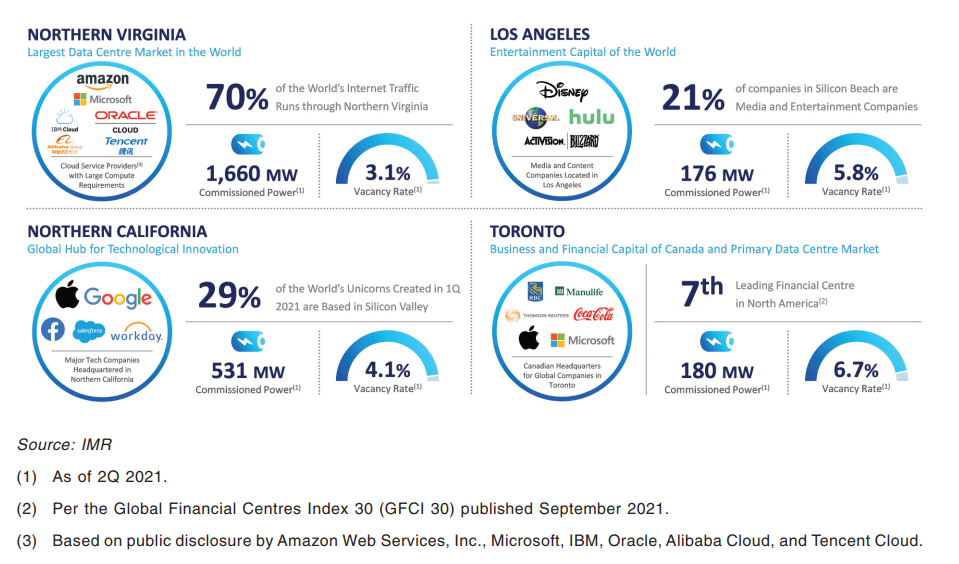

Digital Core REITs initial portfolio comprises 10 freehold data centres in key markets of the US and Canada with an appraised valuation of 14 billion and a net rentable area of 12 million square feet 111484 square metres. Digital Core REITs Distribution Details. Scheme Number Scheme Name Umbrella Fund Name Scheme Status Scheme Manager.

The REIT is projecting a distribution yield of 475 for forecast year 2022 and DPU growth of 526 from forecast year 2022 to projection year 2023. Digital Core REIT is expected to have an aggregate leverage of 27 per cent as at the listing date -significantly lower than its peers - giving it a debt headroom of up to US596 million. Why you should avoid Digital Core REIT IPO.

Most expiry coming from. Is a Singapore PRIVATE COMPANY LIMITED BY SHARES. Digital Realty plans to co-invest in Digital Cores future assets by taking a 10 stake.

A REIT sponsored by a REIT. Relieve stress Digital Core REIT sponsored by US-listed Digital Realty Trust is set to raise 600 million in an initial public offering IPO in Singap. The Company current operating status is live and has been.

This has some interesting implications on conflicts of interest that we. DC REIT has disclosed that their biggest customer has a AAA credit rating. According to the preliminary prospectus the manager intends to raise gross proceeds of approximately US977 million from the offering including the issuance of the sponsors subscription units and the.

As the sponsor they will own 39 interest in Digital Core REIT through Digital CR Singapore Holding LLC. Digital Core REIT is expected to have a gearing ratio of around 27 below its listed peers in Singapore. The Company is a Private Company Limited by Shares incorporated on 2 July 2021 Friday in Singapore.

Digital Core REIT will indirectly hold a 90 percent interest in the 10 properties in the IPO portfolio while the sponsor will retain a 10 percent holding the filing said. You read that right. The Business current operating status is Live Company.

Digital Core REITs initial portfolio comprises 10 freehold data centres in key markets of the US and Canada with an appraised valuation of 14 billion and a net rentable area of 12 million square feet 111484 square metres. To start off this is just an alternative view amidst the recent hype and optimism seen from some financial bloggers. The address of the Companys registered office is at the OCEAN FINANCIAL CENTRE building.

Cornerstone investors or the larger institutional investors will take up 608 of the total IPO size. As Digital Core REITs final IPO prospectus is not out yet some details are not available. Digital Core REIT will be the exclusive S-REIT vehicle sponsored by Digital Realty the largest global provider of cloud- and carrier-neutral data centre colocation and interconnection solutions.

Digital Realty is one of the 10 largest US-listed REITs. Their top 10 customers are extremely high in quality. There are currently only two US corporations with a AAA credit rating namely Microsoft and JohnsonJohnson of which only one of them is a software company.

PURE play data centre real estate investment trust Reit Digital Core Reit intends to raise total gross proceeds of US977 million from its initial public offering IPO on the Singapore Exchange including the issuance of the sponsor units cornerstone units and parent US Reit preference shares. The Real Estate Investment Trust REIT which owns 10 freehold data centres in the United States and Canada worth around 14 billion is issuing 682. REITs are well-known to be able to dish out distributions to unitholders regularly.

The sponsor Digital Realty is one of the largest listed US REITs with a well-established track record and public market expertise in the data centre industry. The facilities are fully leased to a roster of blue-chip customers each with numerous deployments across Digital Realtys global platform. Digital Realty NYSE.

According to a preliminary prospectus filed with the Monetary Authority of Singapore MAS on 22 November Digital Core REIT will have an initial portfolio of 10 data centres across North America valued at USD14 billion.

Reit Investing And The Active Advantage Insights Cohen Steers

12 Days Of Christmas In The Classroom Is An Engaging And Educational Way To Count Down To Christmas Bre Christmas Teaching Christmas School Christmas Classroom

Data Center Reits Battle Of The Clouds Seeking Alpha

Cute Bear Designed By Holl 87 You Need A Logo Just Tap The Link In Bio Logotoons Logo Illustrations B Kids Logo Design Bear Cartoon Character Design

Creating A Logo For A Real Estate Investment Trust Reit Manager By Bola Bolo Property Investor Real Estate Investment Trust Custom Logo Design

Reits Lead In Using Ai Technologies Prescriptive Data

Tax Excellence Team Workshop On Immovable Property Today Future Etc For More Detail Call Now At 02134329108 0323322925 Workshop Projects To Try Reit

YOU MAY LIKE :

/cloudfront-us-east-2.images.arcpublishing.com/reuters/GYQ2QP4Z6NJ4JCY3ASJLYSGGVQ.png)